The Dynasty Investor: 2025 Clusters

Jay Stein applies investment and valuation concepts to fantasy football.

Methodology: The way we measure value in the Dynasty Investor is by looking at a player's KeepTradeCut (KTC) vs. his fantasy point per game (PPG) in a ratio called the price-to-earnings (P/E) ratio. P/E = KTC / PPG / 10. Then, you compare that player's P/E ratio to a like-for-like cluster of players from an age, production, and potential perspective. Players in the same cluster should be valued similarly in the market on a P/E basis. If they aren't, then an arbitrage opportunity exists to create value.

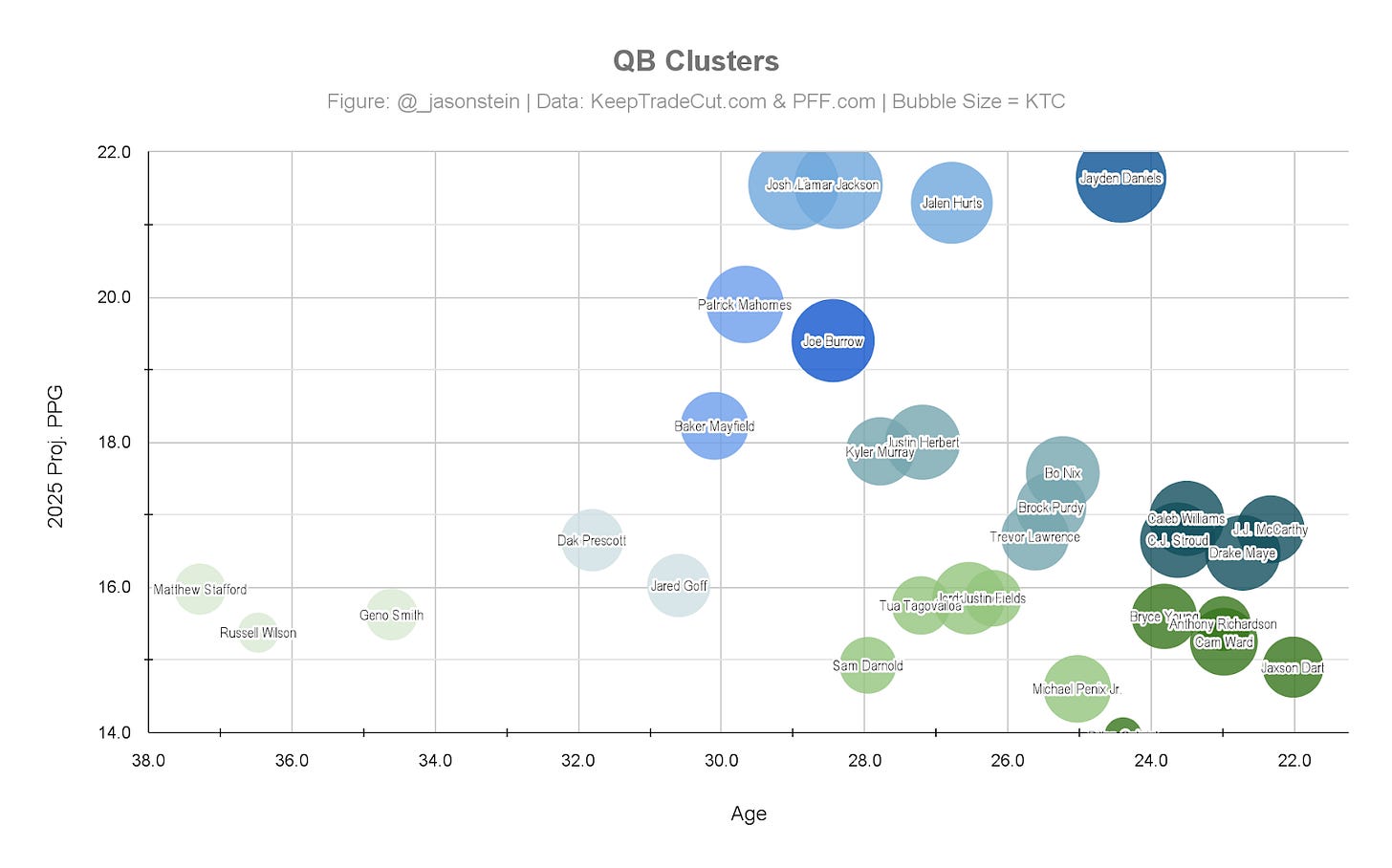

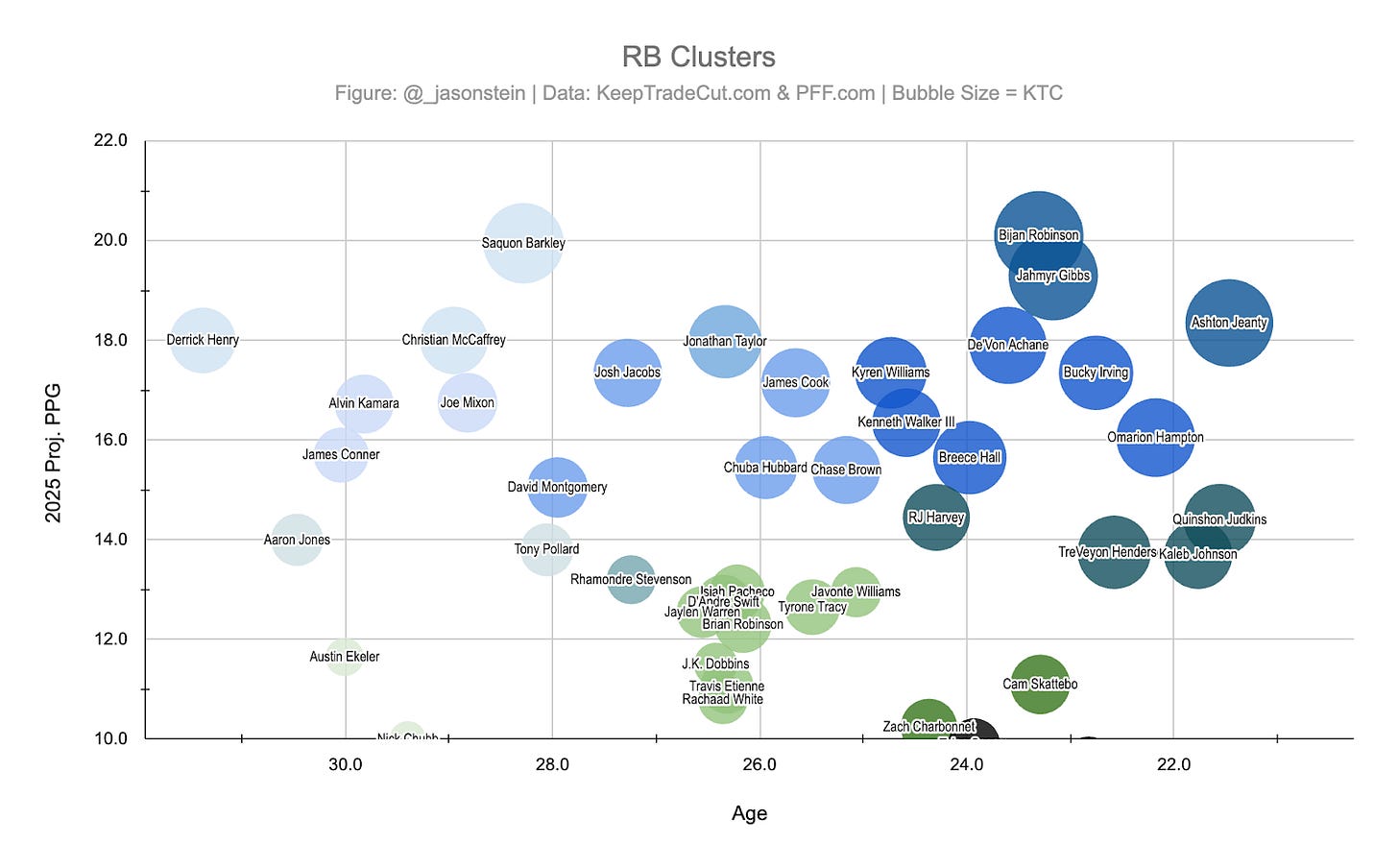

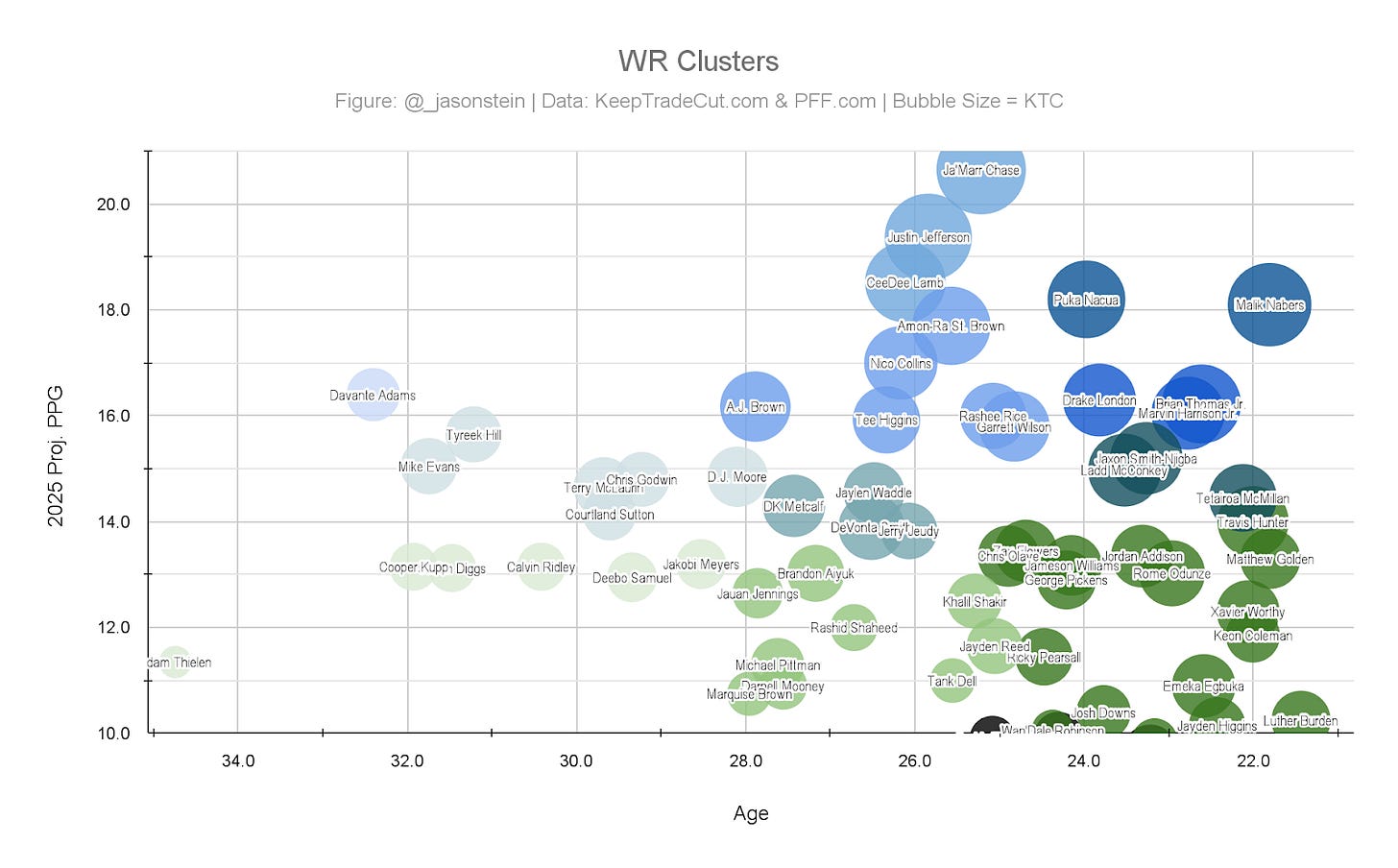

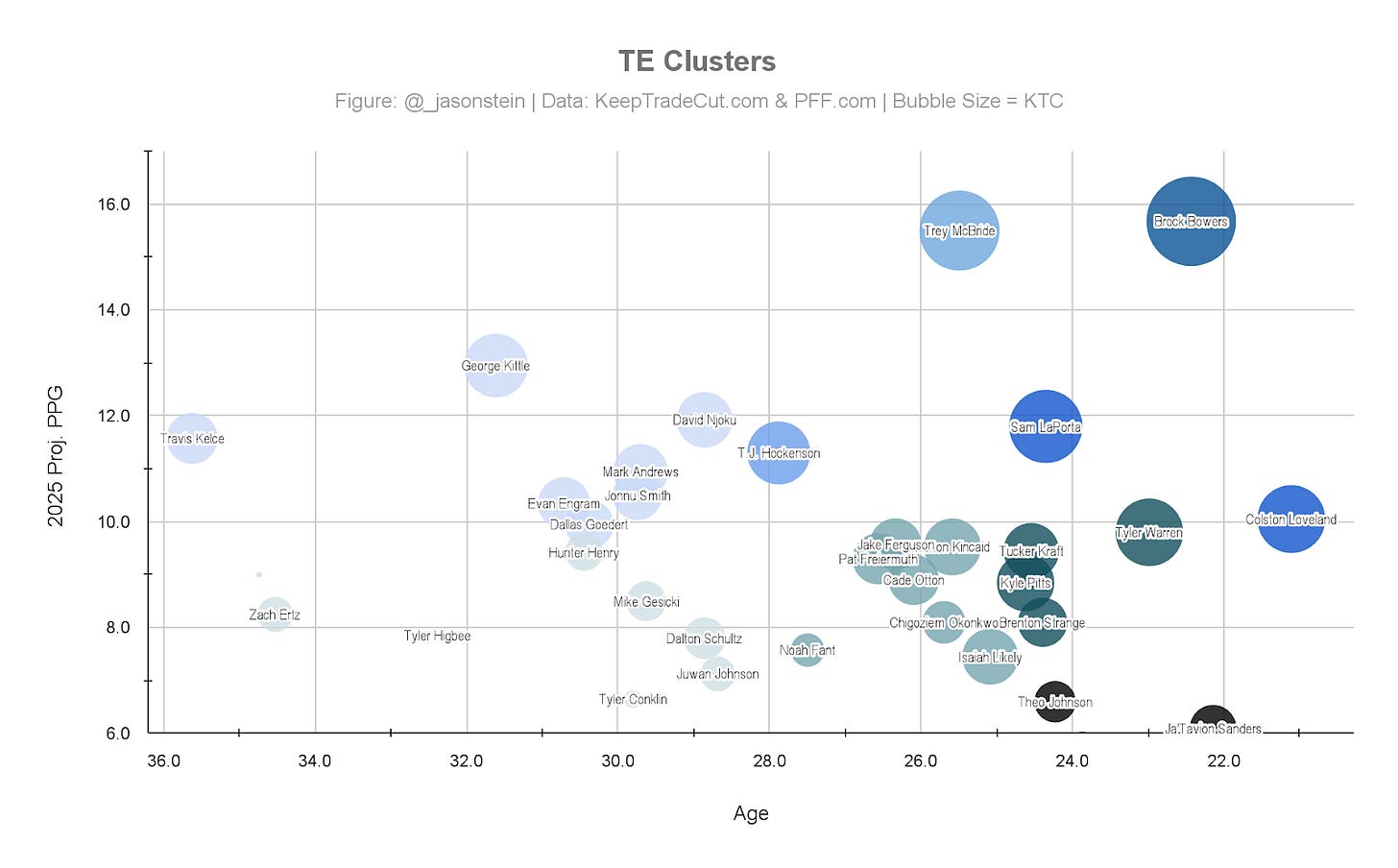

In this month's edition of The Dynasty Investor, we shift our focus to the 2025 landscape by examining projected points per game (PPG) through the lens of cluster analysis. As value investors, our edge lies in identifying inefficiencies—players whose prices don't align with their underlying fundamentals. We can spot these inefficiencies by grouping players into clusters based on age and production. Using 2025 projected PPG as our earnings metric, we've charted the quarterback, running back, wide receiver, & tight end positions to visualize where the market may be mispricing talent. These aren't rankings—they're ecosystems of comparable players, and within them lie the clearest arbitrage opportunities heading into the new season.

Join our TDR Patreon to get access to the new and improved Dynasty Investor spreadsheet, which provides access to real-time player values/clusters.

Updated Positional Cluster Charts

In the realm of Dynasty fantasy football, as in traditional value investing, price is what you pay—value is what you get. Cluster analysis provides a framework for distinguishing between the two. Much like Warren Buffett compares a company's fundamentals to its market valuation, we compare a player's projected production to their perceived market value. However, to make this comparison meaningful, we must look at players not in isolation but as part of a broader ecosystem of similar assets. That's where cluster analysis comes in. By grouping players with comparable age, production, and potential, we create a fair baseline for valuation, just as a seasoned investor might compare a utility stock to its industry peers, not to a high-growth tech company.

This approach helps us avoid the trap of emotional investing—overpaying for flashy names or undervaluing consistent performers. If two players reside in the same cluster but have drastically different price-to-earnings (P/E) ratios, we have a clear signal: one is likely overvalued, the other undervalued. Buffett has long advocated buying quality companies at reasonable prices rather than chasing hype. In fantasy terms, this means identifying productive, young assets that the market has priced inefficiently relative to their cluster. When we use cluster analysis thoughtfully, we aren't just reacting to market sentiment—we're uncovering opportunities where the fundamentals tell a different story than the crowd does. That's where long-term fantasy value is built.

Below are the updated positional charts broken up into clusters of similar players by age and PPG. These are NOT rankings; they are groupings of like-for-like players. The clusters are graphed with increasing projected 2025 PPG on the vertical axis and decreasing age (youngest on the right) on the horizontal axis. Visually, these clusters are grouped by color. Also, the size of the bubble represents each player's KTC, so the bigger the bubble, the higher the KTC.

Now that you've seen the positional cluster charts, hopefully, the landscape looks a little clearer. By grouping players with similar ages and projected 2025 PPG, we've identified where the market aligns — and, more importantly, where it doesn't. Use these insights to recalibrate your portfolio, targeting the undervalued assets within each group while staying disciplined about those priced above their fundamentals.

And now to the upgrades and downgrades.

Dear Readers,

We’re an independent site thriving thanks to the support of our valued members. By signing up for our Substack or Patreon, you’re directly contributing to keeping our business running. Subscribing to Patreon grants you access to Substack content and our exclusive material. Your support is crucial, and we sincerely appreciate your commitment.

Thank you for helping us continue our work.

Keep reading with a 7-day free trial

Subscribe to The Royale to keep reading this post and get 7 days of free access to the full post archives.